The Link between our Directors' Remuneration Policy and our Strategy

Dechra's Policy is designed to promote the long term success of the Group and to reward the creation of long term value for shareholders. The performance targets for all incentive elements are designed to reward high performance, whilst not encouraging inappropriate business risk taking.

The table below describes how certain remuneration elements are linked to our strategy.

| Remuneration Element | Strategic

Growth Driver and Enabler | | Link to our Key Performance Indicators |

|---|

Annual Bonus

Our annual bonus incentivises the delivery of the long term strategy through the achievement of short term objectives. |   | | Sales Growth |

90% of the opportunity is based on a stretching profit target which requires performance above budget and market expectations to trigger the payment of a maximum bonus. |   | | Strong sales performance is required to maximise profit |

The balance of the bonus is based on the achievement of personal objectives which reflect the priorities of the business, achievement of which is necessary to deliver the longer term strategy. |   | | |

Long Term Incentive Plan

The LTIP is designed to reward the generation of long term value for shareholders. Performance measures reflect our long term objectives including sustainable profit growth and the enhancement of shareholder value. Awards are based on growth in EPS and the delivery of shareholder returns. For the 2019 and 2020 financial year awards, the weightings are two thirds EPS and one third total shareholder return. |   | | Underlying Diluted EPS Growth |

The application of a ROCE underpin focuses Executives on using capital efficiently and appropriately to allow the business to capitalise on growth opportunities in new territories and markets whilst maintaining returns. |   | | Return on Capital Employed |

The post vesting holding period aligns management with the long term interests of shareholders and the delivery of sustained performance. |   | | New Product Sales |

The performance conditions for the LTIP awards to be made in respect of the year ending 30 June 2020 and future years will include discretion to override formulaic outcomes. |  | | This measure encourages innovation, growth and sustainability |

Generation of Long Term Value for Shareholders/Alignment of Interests

The Policy is designed to promote long term Group success and to reward the generation of shareholder value. A significant proportion of the remuneration opportunity is linked to the achievement of stretching performance targets. The interests of shareholders and executives are further aligned by formal shareholding guidelines. Executive Directors are required to retain half of any shares acquired under the LTIP and, if relevant, any recruitment award (after sales to cover tax) until such time as their holding has a value equal to 200% of their base salary. | |

How Did We Perform During 2019?

£117.4m

Underlying Profit Before Tax

16.6%

Underlying Diluted EPS Growth (CER)

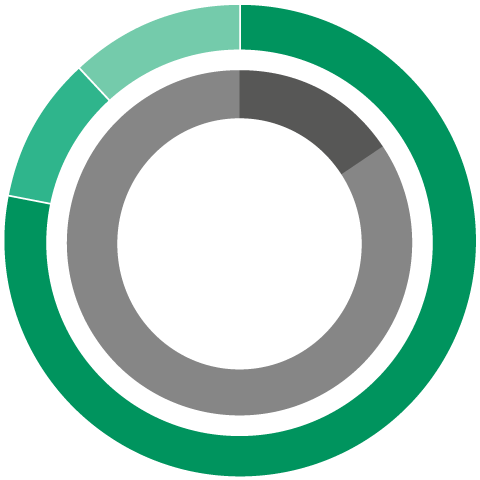

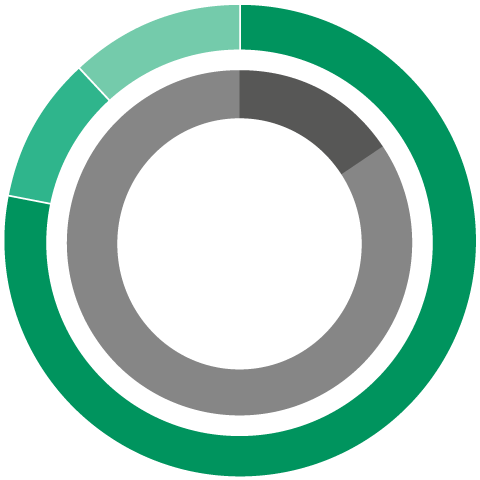

Executive Director Total Remuneration

Ian Page

2019

2018

| 2018 | 2019 |

| Fixed | | |

| Salary | 16.4% | 16.8% |

| Benefits | 2.1% | 2.0% |

| Pension | 2.5% | 2.4% |

| Performance-linked | | |

| Bonus | 12.4% | 12.1% |

| LTIP | 66.6% | 66.7% |

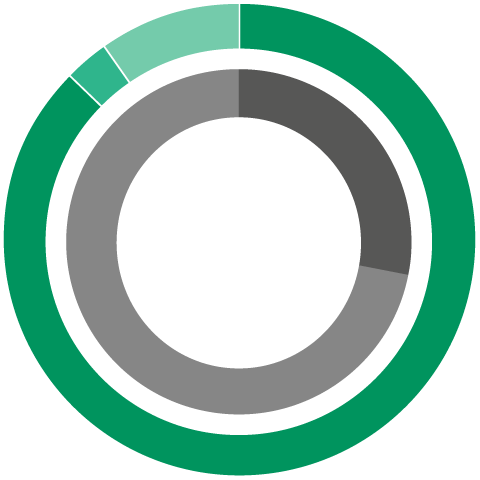

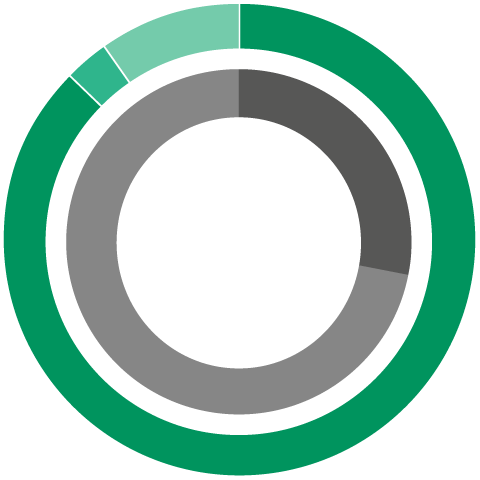

Tony Griffin

2019

2018

| 2018 | 2019 |

| Fixed | | |

| Salary | 28.2% | 27.1% |

| Benefits | 0.9% | 0.9% |

| Pension | 3.0% | 3.0% |

| Performance-linked | | |

| Bonus | 20.7% | 19.5% |

| LTIP | 47.2% | 49.5% |